India’s Exports of Ready To Eat products rises by 24% to $ 394 million in 2021-22 (April-October) compared to 2020-21 (April-October)

India’s export of

final consumer food products such as Ready to Eat (RTE), Ready to Cook (RTC)

and Ready to Serve (RTS) under the APEDA basket has registered a significant

growth in the last one decade.

With the Ministry of

Commerce & Industry laying thrust on Value Addition of products for

exports, the food products under the RTE category have registered an Compound

Annual Growth Rate (CAGR) of 12 per cent in the last one decade and the share

of RTE in APEDA export has increased from 2.1 per cent to 5 per cent during the

same period.

The export of

products under Ready to Eat (RTE), Ready to Cook (RTC) and Ready to Serve (RTS)

segment have registered an CAGR of 10.4 per cent from 2011-12 to 2020-21. India

exported more than $ 2.14 billion worth of final food products in 2020-21.

Since final food products are time saving and readily available, the demand for

food items under the categories of RTE, RTC and RTS has increased manifold in

recent years.

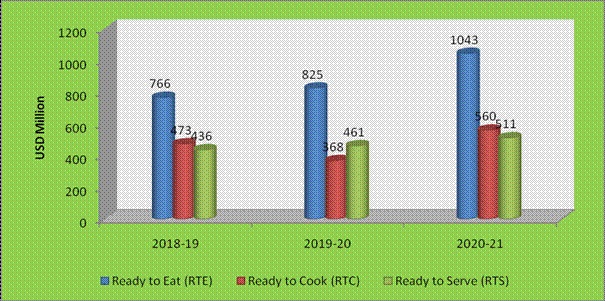

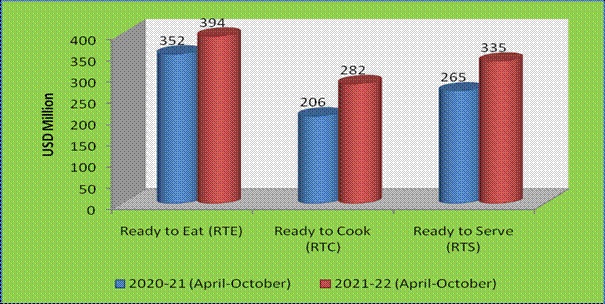

The export of products

under RTE, RTC and RTS categories rose by more than 23% to $ 1011 million in

April – October (2021-22) compared to $ 823 million reported in April – October

(2020-21). In view of this, export of RTE/RTC and RTS for last three years is

placed in below graph.

Source: DGCIS

According to the

latest Directorate General of Commercial Intelligence and Statistics data,

India exported final food products which includes RTE, RTC and RTS, worth USD

5,438 million in the last three financial three years (2018-19 and 2020-2021).

In 2018-2019, India

recorded RTE exports of USD 766 million, which rose to USD 825 million in

2019-20 and USD 1043 million in 2020-21. Meanwhile, the RTC food products

recorded an export of USD 473 million in 2018-19, USD 368 million in 2019-20

and USD 560 million in 2020-21. A comparative analysis of RTE/RTC and RTS for

the current year, April--October (2021-22) against previous years for the same

periods is placed in below graph. Export value of RTE/RTC and RTS has increased

in 2021-22 against previous year.

Source: DGCIS

The RTS food category

registered an export of USD 436 million in 2018-19, USD 461 million in 2019-20

and USD 511 million in 2020-21.

The products covered

under RTE category, includes Biscuits & Confectionery, Jaggery, Breakfast

Cereals, Wafers, Indian Sweets and Snacks, Pan Masala & Betal Nuts etc. The

Biscuits and Confectionery and Indian Sweets and Snacks constitute a major

share of 89% in the RTE export in 2020-21.

The share of each

category in RTE export are 52.32% (Biscuits & Confectionery), 1.52%

(Jaggery), 4.11% (breakfast cereals), 1.73% (wafers), 37.04% (Indian sweets and

snacks), and 3.28% (Pan Masala and Betal nuts).

The growth rate of

RTE in 2020-21 against previous year was 26% while growth in Biscuits &

Confectionery category recorded at 28.87%, Jaggery at 48.18%, Breakfast Cereals

at 4.24%, Indian sweets and snacks at 29.75%, Pan Masala and B’nuts at 4.2% for

the same period.

Notably more than 56%

of RTE food products were exported to top 10 countries in 2020-21. USA is the

top importing country in four categories of RTE products such as Biscuits &

Confectionery (USD 79.54 million), Breakfast cereals (USD 5.33 million), Indian

sweets and snacks (USD 99.7 million), Pan Masala & Betal Nuts (USD 5.95

million) while the remaining two products under RTE are significantly imported

by Malaysia and Nepal. Malaysia imported Jaggery worth of USD 5.09 million and

Nepal imported Wafers worth of USD 3.5 million in 2020-21.

The major destination

of RTE export as per 2020-21 data are U.S.A (18.73%), U.A.E (8.64%), Nepal

(5%), Canada (4.77%), Sri Lanka (4.47%), Australia (4.2%), Sudan (2.95%), U.K

(2.88%), Nigeria (2.38%), Singapore (2.01%).

The RTC food products

have been growing at CAGR of 7 per cent in the last one decade and the share of

RTC in APEDA export has increased from 1.8 per cent to 2.7 per cent in the same

periods. The major categories of food products covered under RTC are ready to

cook, papad, flours and milled products and powder and starch. The

category-wise share in RTC export is ready to cook (31.69%), papad (9.68%),

flours and milled products (34.34%) and powder & starch (24.28%).

The growth rate of

RTC in 2020-21 against previous year is 52 per cent while category wise growth

rate of RTC is highest for powder and starch (174%) followed by Flours and

Milled Products (36%), Ready to Cook (35%) and Papad (19%) in 2020-21 against

previous year.

Above 74% of RTC food

products were exported to top 10 countries in 2020-21 and USA is the top

importing country of Flours and Milled Products and Ready to Cook from India in

2020-21 while two countries namely UK and Indonesia are at the top in importing

of Papad and Powder & Starch during 2020-21.

The major exporting

destination for RTC export in 2020-21 are U.S.A (USD 18.62 million), Malaysia

(USD 11.52 million), U.A.E (USD 8.75 million), Indonesia (USD 7.52 million), UK

(USD 7.33 million), Nepal (USD 5.89 million), Canada (USD 4.31 million),

Australia (USD 4.2 million), Bangladesh (USD 3.43 million) and Qatar (USD 2.76

million).

In the category of

RTS, the export has been growing at an CAGR of 11 per cent in the last one

decade. The major final food products under the RTS category include jellies,

squash & juices, other beverages, energy products/drinks and ice cream,

soups, sauces, pasta and seasoning. The share of RTS has increased from 1.1 per

cent to 2.5 per cent in last one decade.

The growth rate of

RTS in 2020-21 against previous year (2019-20) is 11 per cent while

category-wise growth rate of RTS is highest for Energy Products/Drinks (31.10%)

followed by Ice Cream, Soups, Sauces, Pasta and Seasoning (19.34%), other

beverages (14.12%).

The rise in export of

agricultural and processed food products has been largely due to the various

initiatives taken by APEDA such as organizing B2B exhibitions in different

countries, exploring new potential markets through product specific and general

marketing campaigns by active involvement of Indian Embassies.

APEDA has also taken

several initiatives to promote geographical indications (GI) registered

agricultural and processed food products in India by organizing virtual Buyer

Seller Meets on agricultural and food products with the major importing

countries across the world.

In order to ensure

seamless quality certification of products to be exported, APEDA has recognized

220 labs across India to provide services of testing to a wide range of

products and exporters.

APEDA also assists in

upgradation and strengthening of recognized laboratories for export testing and

residue monitoring plans. APEDA also provides assistance under the financial

assistance schemes of infrastructure development, quality improvement and

market development for boosting export of agricultural products.

India’s

exports of RTE, RTC & RTS (USD million)

|

|

2018-19 |

2019-20 |

2020-21 |

2020-21 (April-October) |

2021-22 (April-October) |

|

Ready to Eat (RTE) |

766 |

825 |

1043 |

352 |

394 |

|

Ready to Cook (RTC) |

473 |

368 |

560 |

206 |

282 |

|

Ready to Serve (RTS) |

436 |

461 |

511 |

265 |

335 |

Source: DGCIS\