Major Logistics Trends Shaping Logistics Management in 2022

The unwritten rule across any industry (& also logistics industry) is that disruptive forces are constantly at play, reshaping the way organizations think about technology, conduct business, and look to the future. From new technologies to explore and take advantage of, to shifting regulations that require new strategies and tactics to ensure compliance, logistics companies must stay plugged into new and emerging trends to stay at the bleeding edge and remain competitive.Companies that succeed are the ones who embrace a combination of the latest trends and utilize them in a way that capitalizes on traditional and established technologies.

Let us analyze the trends shaping logistics management:

1. RFID

For over a decade, Radio-frequency Identity (RFID) chips have promised to provide real-time tracking information. However, while many OFD (out-for-delivery) companies have invested a lot of money in RFID, they have yet to see a real ROI from the technology.

So why is that? Simply having RFID chips doesn’t mean you have better access to the data, because you need computers near the data to collect it and share it.

Companies also need file-based integration technology that is able to connect devices and edge computing systems back to the core enterprise systems to transfer reporting documents and where the data can be stored and analyzed for insight and business decision making.

Further, the logistics companies that do utilize RFID technology to a value-producing extent are the ones that are able to blend traditional line-of-sight technology such as barcode labels with RFID. Barcode labels are well-established and relatively low cost. The underlying systems and business processes are well-understood and common.

By comparison, RFID implementation can be a high-cost addition to the logistics supply chain. Some estimate a 10X cost factor for implementing RFID tags versus bar codes. The price barrier for investment is one reason a blended approach to traditional and new makes sense. Additional concerns around data accuracy and reliability should also play a role in how a company chooses to leverage RFID.

RFID in logistics has potential particularly in route optimization, and the real-time tracking of goods. When effectively integrated, RFID systems can provide precise location and quantity data in real-time. For instance, tagging trucks, pallets, and inventory provides multi-lateral views of what is happening across the supply chain.

The importance of knowing exactly where a specific truck is at any given moment can allow a logistics company to be more proactive, to change a delivery route given unpredictable events such as accidents and weather.

Companies that mix-and-match traditional and legacy technology with next-generation advancements are the ones who end up most successful. Those companies understand that attempting to completely replace established technology and business processes is unwise. New technology tends to perform better in conjunction with what is established and standardized.

2. Omnichannel Shipping

Omni-channel fulfillment is an increasing reality in the logistics industry, one that is being spurred on by a shifting approach to meeting customer expectations in the retail industry.

According to the Harvard Business Review, the Amazon effect is driving traditional retailers to offer more omnichannel touchpoints to increase customer loyalty. The goal is to provide a seamless and easy way to shop, regardless of whether it’s conducted digitally or in-store.

In this context, successful logistics companies are those that have evolved to offer more creative approaches to shipping to navigate growing omnichannel complexities within the supply chain.

Here is a simplified look at possible omnichannel fulfillment and return order flows directly to (and from) the end customer:

Warehouse to consumer and back

Supplier to consumer and back

Store to consumer and back

Distribution center to consumer and back

Traditionally, the shoppers would travel to the purchased item. The “last mile,” so to speak, was thereby on the customer. Now, last-mile-logistics are falling on the shoulders of the retail logistics providers and their partners. The changing expectation is for retail logistics deliveries to operate like USPS. In fact, companies such as Amazon actually contract USPS to handle these deliveries since their system is already in place.

Walmart is approaching the challenge of last-mile logistics in a uniquely alternate fashion. They have implemented an employee drop-off system, incentivizing employees to drop off packages as they travel home at the end of a shift. Additionally, in September 2017, Walmart acquired New York-based last-mile delivery specialist, Parcel.

Because of e-commerce and omnichannel trends, the last-mile evolution of shipping methods has increased the complexity of the supply chain. And further, no longer is one-way logistics enough to compete.

3. The Big Promise of Big Data

UPS may be the biggest success story for big data in the logistics industry. Through data collection, analysis, and demand forecasting, the company has made massive strides in operational efficiencies and cost savings.

Some 80,000 vehicles each have more than 200 onboard sensors that measure speed, braking, backing up, location, and idling time. Some of the sensors collect diagnostic data on the vehicle battery and tire pressure, allowing for preemptive maintenance. The goal is to maximize the time a vehicle is on the road versus in the shop. Further, big-data-driven predictive modeling is the basis for massive gains in route optimization.

Because of the proliferation of GPS and location sensors, along with real-time traffic updates, companies now are able to optimize delivery windows regardless of construction, parades, accidents, and the like. Companies utilizing big data technology, create systems to allow them to change their route in real-time. This is done for a couple of reasons.

The first, of course, is to minimize fuel consumption. UPS has leveraged big data to reduce fuel usage by an estimated 1.5 million gallons in 2012, greatly reducing the environmental impact and increasing operating margins through efficiency gains.

Another big data outcome related to route optimization is to decrease mileage. The level of savings that companies in terms of mileage, impact the wear and tear on vehicles.

UPS further specializes inefficiency in an unusual way. According to their CEO, UPS “trucks never turn left.” When a route optimization specialist maps out the optimal path, they provide right-turn-only directions to drivers. It’s an innovative solution built on decreasing the amount of time a vehicle spends at red lights, and it works.

While some forward-thinking companies are starting to invest in greener technology as well as big data initiatives. Many supply chain companies are coming up with new techniques that parallel the outcome of route optimization through how a mastery of inventory logistics management, optimizing shipments for efficiency.

4. Embedded Integration Technology

Logistics companies are also utilizing embedded technology to better connect with their customers. They recognize that they need a data movement platform to seamlessly share data reliably back-and-forth between their customers.

Embedded integration capabilities provide SaaS companies in the logistics space to offer value-added services related to logistics and supply chain data. This is a true encapsulation of digital transformation as more traditional logistics enterprises are evolving to data-centric services companies.

Organizations are taking advantage of modern services and solutions to take in data, process it, and provide insight to customers. The ability to be more dynamic than ever before by providing fast and critical information to and from customers is central to a business’ success.

An embedded data platform provides secure communications protocol flexibility that enables robust transactional business flows. You need to be able to connect, transform, and integrate data through capabilities that are already built into the solution. Customers want to know everything, and information is of the utmost importance. Service-level agreements (SLA) must also be met, and companies are taking advantage of embedded software with business-level dashboard views and 24/7 monitoring to extend visibility throughout the process to ensure compliance with tough SLAs.

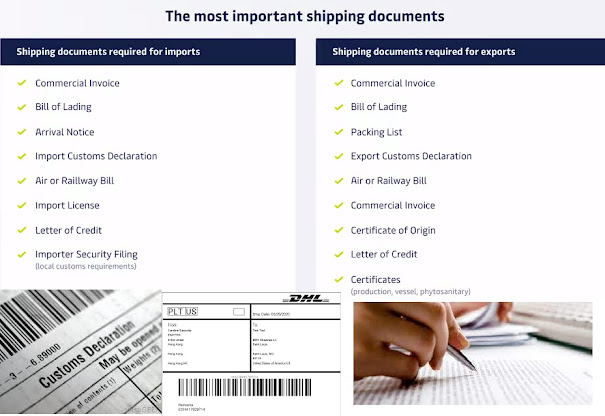

5. Globalization and Compliance

Globalization is forcing many logistics companies to focus on a strategy of achieving delivery KPIs while keeping costs in check.

The need for increased flexibility across the supply chain is paramount along with recognizing that no single solution to the growing complexity will be one-size-fits-all.

The landscape of global trade is one that is constantly shifting. There is an unwavering need for logistics companies to stay ahead of evolving compliance requirements.

This rings especially true for all the ways the enterprise needs to manage critical customer and partner data. Take the recently created Federal Maritime Commission plan to reform regulatory priorities. One recent change in governance directly affected the New York Shipping Exchange and aimed to combat shippers leaving less lucrative cargo behind. While this is a positive change, it is still a change – one that increasingly is happening everywhere.

Further, across the globe, the ability to comply with the plethora of data-related mandates is tied to how capable a company is in its ability to find, view, record, and report on the data. The regulation calls for full auditability and companies need to provide full audit trails to keep track of their data and customers’ data throughout the process with built-in governance and control.

Without the proper ability to comply with provable digital documentation, trucks could end up sitting at the dock, ships get stuck in the harbor, and goods are stranded on trains or tarmac – for hours or even days.

The average cost of a rejected food logistics shipment due to non-compliance ranges from $300 to $40,000. And extrapolated to a global scale, the cost of not being able to clear goods on is extraordinarily significant.

6. Integrated 3PL Services

As e-commerce continues to expand beyond epic proportions, many companies are also seeing quite a bit of potential in integrated 3PL services. Businesses are seeing this by bringing in heavy assets in trucking and adding freight brokerage capabilities and warehouse facilities to provide deep integration into customers’ systems.

As customers advance through their own use of modern technology, logistics companies are embracing logistics automation trends by utilizing API integrations to connect e-commerce stores with a fulfillment center in addition to traditional EDI.

Because supply chains have so many different channels and change so quickly in order to meet consumer demand, fulfillment practices must evolve along with it in order to cope with COVID-19 and any other supply chain disruption that may arise.

Logistics industry trends demand that customers have options when it comes to delivery, from last-mile services to same day and next day delivery and it’s up to providers to make sure that customers have those very delivery options.

7. Re-Optimized Service Lines

When COVID-19 first struck, one of the ways logistics companies started to recover was to re-optimize service lines in order to focus on industries that thrived the most during the pandemic, such as food, paper, and packaging.

This allowed these logistics enterprises to have more of a regular fleet, rather than a non-dedicated, irregular fleet. No, it certainly is not easy for companies to transition and pivot their strategic initiatives, but the end result is one that will prove beneficial for years to come.

8. Embracing Modern Integration Technology

Logistics companies are recognizing the importance of upgrading their legacy environment and evolving to a modern integration platform.

The allure of a modern integration platform is one that provides quicker onboarding of customers, trading partners, and suppliers, as well as provides end-to-end visibility so logistics companies can conduct business quicker.

From frictionless supplier integration to have the ability to unlock back-office systems that are critical to third-party logistics (3PL) services, modernized integration technology can do it all. Logistics businesses everywhere see the value that integration technology has for their supply chain.

Those companies that migrated to a modern integration platform prior to COVID-19 were the ones that put themselves in the very best position to manage disruption to their supply chain. COVID-19 has shined a light on the importance of a modern integration platform.

To conclude...

Today, the logistics industry looks entirely different than it did 10 years ago, the question now becomes... what will it look like in another 10? Market trends, such as those outlined above, are going to continue to impact the logistics sector well into the future. However, the success of trend-shaping nascent technologies requires that they are integrated with existing solutions and infrastructure. Not only do logistics operation needs to be able to enable processes like ingesting an EDI load tender, but also, companies need to look to how future technology can be leveraged to reduce margins. Businesses can then create a next-generation stack that leverages previous technology investments while incubating big data, IoT, and omnichannel solutions.

Furthermore, the events of 2022 have disrupted the entire supply chain and the logistics industry is no exception. The logistics landscape is plagued by uncertainty and disruption, but it is also ripe for digital transformation. Companies that succeed in 2022 and beyond are those that will embrace a combination of the top trends in logistics management to become resilient to supply chain shocks.