The container-shipping industry has been highly unprofitable

over the past five years. Making things worse, earnings have been exceptionally

volatile. Several factors are responsible, notably trade’s spotty recovery from

the global financial crisis, and redoubled efforts by corporate customers to

control costs. Some of the pain is self-inflicted: as in past cycles, the

industry extrapolated the good times and foresaw an unsustainable rise in

demand. It is now building capacity that appears will be unneeded.

These problems are real and significant, and largely beyond the

power of any one company to address. But shipping companies cannot afford to

throw up their hands and accept their fate.

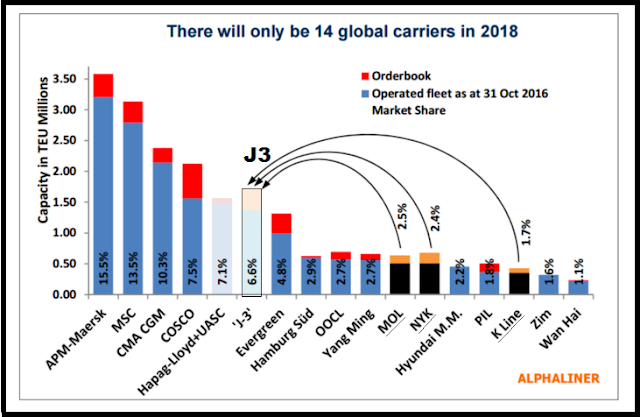

These developments

are leading to alliances, mergers, acquisitions & sale!

Latest in the race is Hamburg Süd. The owners of Hamburg Süd are

tipped to opt for an outright sale rather than a merger. A sale of the Hamburg

Süd by the family owners Oetker conglomerate, which runs the gamut from pizza

and beer to financial services and shipping, would accelerate the consolidation

that has significantly reshaped the financially troubled industry this year.

Who are the buyers?

On 1st December 2016 - Maersk Line and the Oetker Group have reached an agreement for Maersk Line to acquire Hamburg Süd, the German container shipping line. The acquisition is subject to final agreement and regulatory approvals.

On 1st December 2016 - Maersk Line and the Oetker Group have reached an agreement for Maersk Line to acquire Hamburg Süd, the German container shipping line. The acquisition is subject to final agreement and regulatory approvals.

Maersk CEO Soren Skou confirmed in September that Maersk Line is

mulling acquisitions in its bid to grow in line with the market when he

unveiled the group’s new strategy that will split its shipping, ports, and logistics

operations from its energy division.

One company's loss is Another company's gain!

Hamburg-Süd has twice held merger talks with Hapag-Lloyd, most

recently in 2012 and 2013, but the companies failed to agree on shares in an

enlarged carrier. Hapag-Lloyd last week secured approval from the European

Union for its takeover of United Arab Shipping Company.

Up for sale? Who is

next?

Hamburg Süd, along

with Orient Overseas Container Line, Yang Ming Line, Hyundai Merchant Marine,

and Zim Integrated Shipping Services, are coming under increasing pressure to

consolidate following a spate of merger and acquisition deals that have seen

the market leaders pull ahead of mid-ranked carriers.

Hamburg Süd – as a line

Hamburg Süd has focused on north-south routes, particularly

Latin America, where it strengthened its position with the $160 million

acquisition of the container line services of Chile’s CCNI in 2015, and

recently moved into the east-west market through a cooperation agreement with

UASC.

The carrier operates a fleet of 116 ships — 44 owned and 72

chartered — with an aggregate capacity of 600,344 twenty-foot-equivalent units

and a market share of 2.9 percent, according to industry analyst Alphaliner. It

has eight ships of 30,400 TEUs on order.

The Hamburg-based line, which is also involved in bulk shipping

and product tankers, boosted revenue by almost 17 percent in 2015 to just over

6 billion euros ($6.4 billion) driven by the acquisition of CCNI and its debut

on the east-west liner trades. Container traffic last year was up 21.5 percent

at 4.1 million TEUs.

Unlike the majority of its competitors, Hamburg Süd is not a

member of an alliance. The company does not publish profit and loss figures.