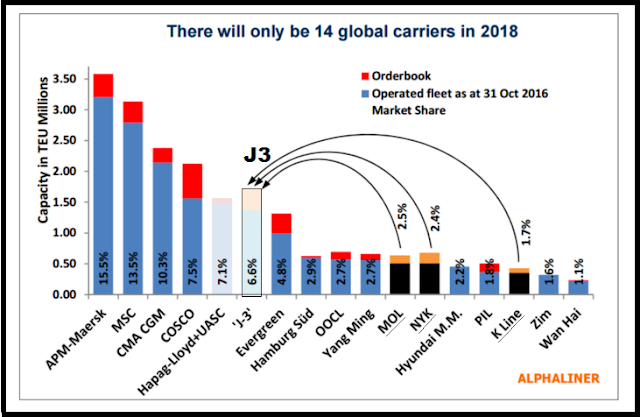

Japan’s big three shipping majors – NYK, K Line, have decided to end decades of fierce rivalry and merge their container shipping businesses into a new line ( a new joint-venture

company ) with a total capacity of 1.4m TEUs , which would rank as the sixth

largest in the world and have a global market share of approximately 7%.

When will J3 be

operational?

The deal was subject to shareholders’ agreement and

regulatory approval with a planned establishment of the new company scheduled

for 1 July 2017, and the target for

business commencement set for 1 April 2018.

What is in it for the

shipping trade?

·

“J-3” will become the world’s sixth-largest

container line, with the top seven lines controlling around 65 percent of the

global liner capacity by 2018.

·

The J3 will operate a combined fleet of some 1.4million

twenty-foot-equivalent units with a global market share of about 6.6 percent, based

·

J3’s JOINT order book totals 358,000 TEUs

Before J3 & After

J3

According to vesselsvalue.com, NYK owns the largest

container fleet, with 68 vessels providing a total capacity 507,046 teu, valued

at $2.33bn; followed MOL, with 35 ships for 307,449 teu, valued at $1.7bn, and

third K Line, which owns 31 containerships with a capacity of 240,440 teu and a

value of $1.2bn.

It has been agreed that the shareholding of the container

line joint venture will be: K Line 31%, MOL 31% and NYK 38%, with a total

contribution of Y300bn, including fleets and share of terminals, but will

exclude terminal operating business in Japan.

:

Why go for J3?

We will look at the reasons for J3 :

We will look at the reasons for J3 :

1. Stability : The

three Japanese companies have made efforts to cut cost and restructure their

business, but there are limits to what can be accomplished individually. Under

such circumstances, the 3 carriers have decided to integrate their container shipping

business so that they can continue to deliver stably high quality and customer

focused products to the market place.

In the past few years container liner shipping has been a

problem child for all three of the Japanese trio as they have found themselves

increasingly unable to match the economy of scale unit benefits enjoyed by the

big three of Maersk Line, MSC and CMA CGM.

2. J3 is part of THE Alliance:

A factor in the decision to merge their container activities is that the

Japanese carriers will all be members of the new THE Alliance east-west vessel

sharing grouping from April next year, which makes the integration

significantly less complex.

After the bankruptcy of Hanjin Shipping and the merging of

the Japanese trio - THE Alliance will be streamlined into three carriers: Hapag-Lloyd,

Yang Ming and the new Japan carrier J3 , thus overcoming the “too many cooks”

criticism that has previously been levelled by analysts at the grouping.

3. Japanese shipping majors share a Common corporate

culture : Moreover, the Japanese shipping groups have a close relationship

that stems from their “common corporate culture” with senior executives and

operational management naturally familiar with their counterparts at the other

companies.

4. Competition’s M&A activity: The container shipping industry

witnessed a flurry of M&A activity in the past year – with of CMA CGM’s

acquisition of NOL, Hapag-Lloyd’s merger with UASC, and the merging of the two

Chinese state-owned lines – has widened the gap in this sector and proved a

drag on consolidated group results for the Japanese companies.

According to Alphaliner data the merger of Hapag-Lloyd and

UASC will lift the German carrier to fifth in the world rankings at 1,479,968

teu capacity, behind the merged Cosco and CSCL at 1,560,999 teu, with the

proposed Japanese grouping taking the sixth spot with 1,369,728 teu.

|

| Top Lines - in 2018? |

Other facts: The three companies all operate portfolios of diversified enterprises that include: bulk shipping, car transportation, LNG, tankers, offshore, energy heavy lift and air cargo transportation.The three japanese majors have significant overlapping interests in terminals worldwide which may need to be rationalized.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.